Financial Highlights

- (a) Adjusted Ebitda Reconciliation

-

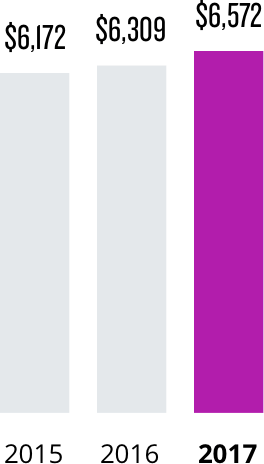

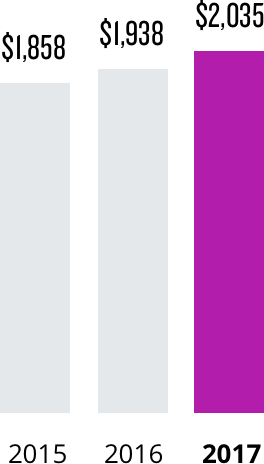

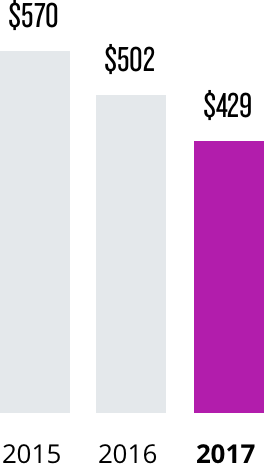

($ millions) 2017 2016 2015 Net income $429 $502 $570 Interest expense, net 370 329 307 Provision for income taxes 388 309 383 Depreciation and amortization 640 603 574 EBITDA 1,827 1,743 1,834 Equity in net loss of affiliates — — 3 Other non-operating expense/(income), net 38 3 (170) Restructuring charges 80 105 51 Stock-based compensation expense 45 51 48 Other items(a) 45 36 92 Adjusted EBITDA(b) $2,035 $1,938 $1,858 (a) For the year ended December 31, 2017, other items primarily consist of transaction related costs and business optimization costs. For the year ended December 31, 2016, other items primarily consists of business optimization costs. For the year ended December 31, 2015, other items consist of a $36 million donation to the Nielsen Foundation, a $14 million charge for the partial settlement of certain U.S. pension plan participants, and business optimization costs.

(b) We define Adjusted EBITDA as net income or loss from our consolidated statements of operations before interest income and expense, income taxes, depreciation and amortization, restructuring charges, stock-based compensation expense and other non-operating items from our consolidated statements of operations as well as certain other items that arise outside the ordinary course of our continuing operations. We use Adjusted EBITDA to measure our performance from period to period both at the consolidated level as well as within our operating segments, to evaluate and fund incentive compensation programs and to compare our results to those of our competitors.

- (b) Free Cash Flow Reconciliation

-

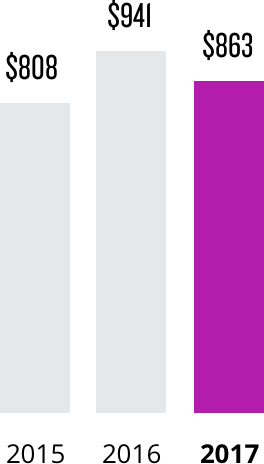

($ millions) 2017 2016 2015 Net cash provided by operating activities $1,310 $1,296 $1,209 Non-recurring contribution to the Nielsen Foundation 36 Capital expenditures, net (447) (391) (401) Free Cash Flow(a) $863 $941 $808 (a) We define free cash flow as net cash provided by operating activities, plus contributions to the Nielsen Foundation, less capital expenditures, net. We believe providing free cash flow information provides valuable supplemental liquidity information regarding the cash flow that may be available for discretionary use by us in areas such as the distributions of dividends, repurchase of common stock, voluntary repayment of debt obligations or to fund our strategic initiatives, including acquisitions, if any. However, free cash flow does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from free cash flow. Key limitations of the free cash flow measure include the assumptions that we will be able to refinance our existing debt when it matures and meet other cash flow obligations from financing activities, such as principal payments on debt. Free cash flow is not a presentation made in accordance with GAAP.

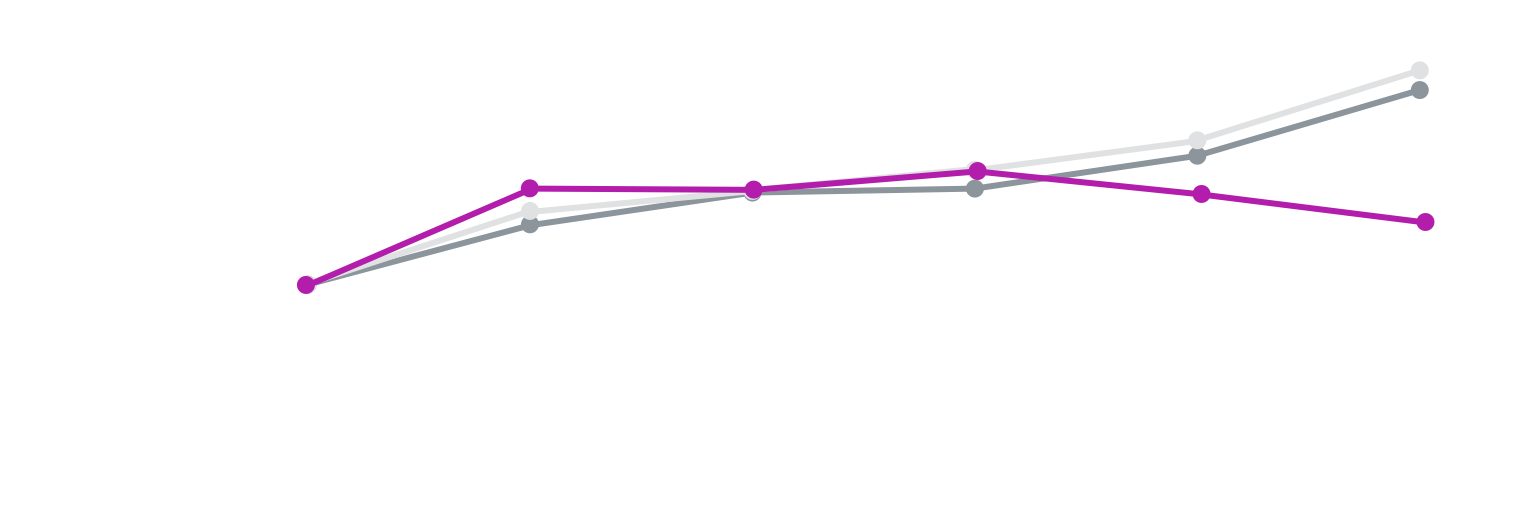

The following graph shows a comparison of cumulative total shareholder return for our common stock, the market cap weighted composite of the Peer Group and the S&P 500. The comparison assumes that $100 was invested in Nielsen Holdings plc common stock and each of the indices over the period beginning December 31, 2012 and ending December 31, 2017, and that dividends were reinvested.

(c) The Peer Group composite is based on the companies in Nielsen’s 2017 Long Term Performance Plan peer group. The Peer Group is composed of: Accenture plc, The Dun & Bradstreet Corporation, Equifax Inc., Experian plc, FactSet Research Systems Inc., Gartner, Inc., IHS Markit Ltd., The Interpublic Group of Companies, Inc., Moody’s Corporation, MSCI Inc., Omnicom Group Inc., Publicis Groupe S.A., RELX (NV), S&P Global Inc., Thomson Reuters Corporation, Verisk Analytics, Inc., Wolters Kluwer N.V., and WPP plc; one previously included peer company (GfK SE) has been excluded following its acquisition in 2017; one current peer (IQVIA Holdings Inc., formerly QuintilesIMS Holdings, Inc.) has been excluded due to an insufficient trading history to determine a 5-year total shareholder return value as of December 31, 2017.