Proxy Highlights

Letter from Our Board Chairperson

2017 Performance Highlights

We are dedicated to driving shareholder value by posting solid operating performance. The Company’s long-term business performance and progress against strategic initiatives form the context in which pay decisions are made. We have delivered resilient business performance with sustained growth over the last three years.

During 2017:

Compensation Highlights

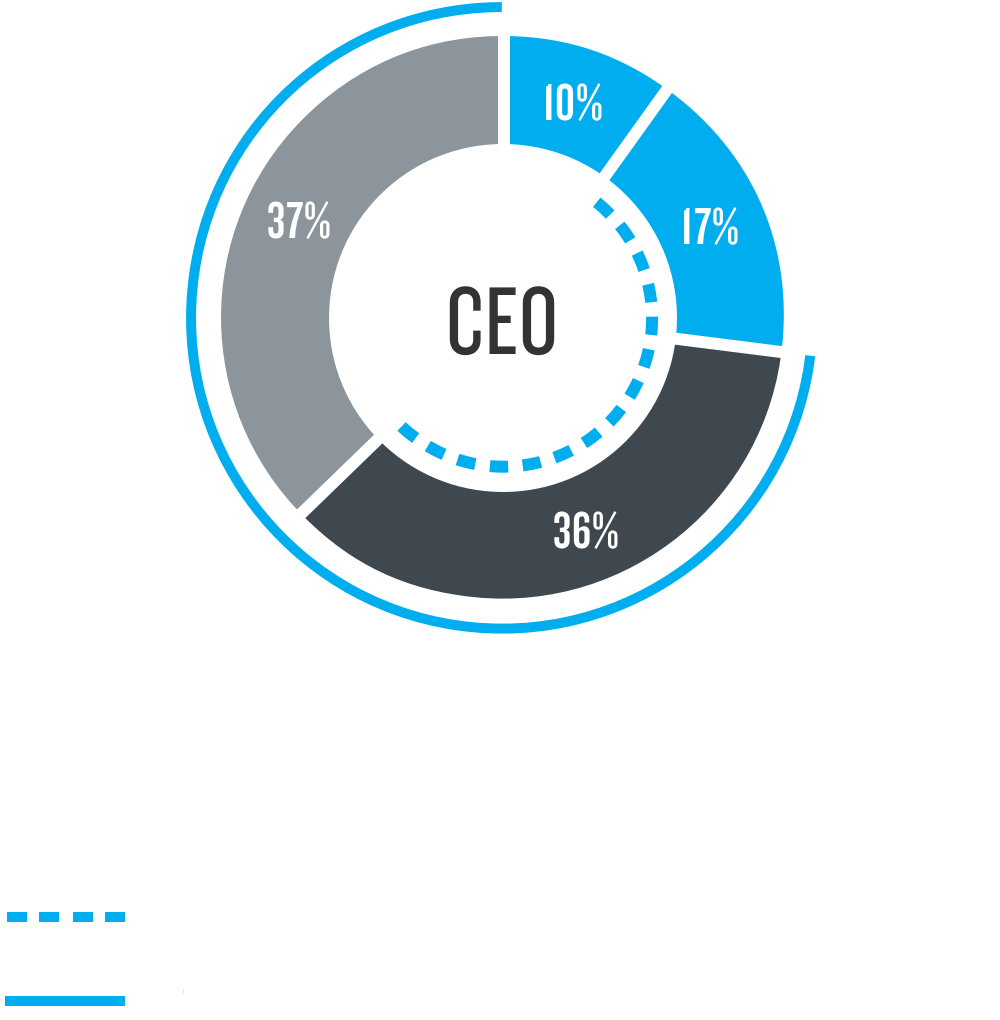

Structure 2017

incentive

(three-year performance period)

| Proportion of pay subject to specific quantitative performance criteria | 53% |

| Proportion of pay at risk | 90% |

| Proportion of pay delivered in the form of equity | 73% |

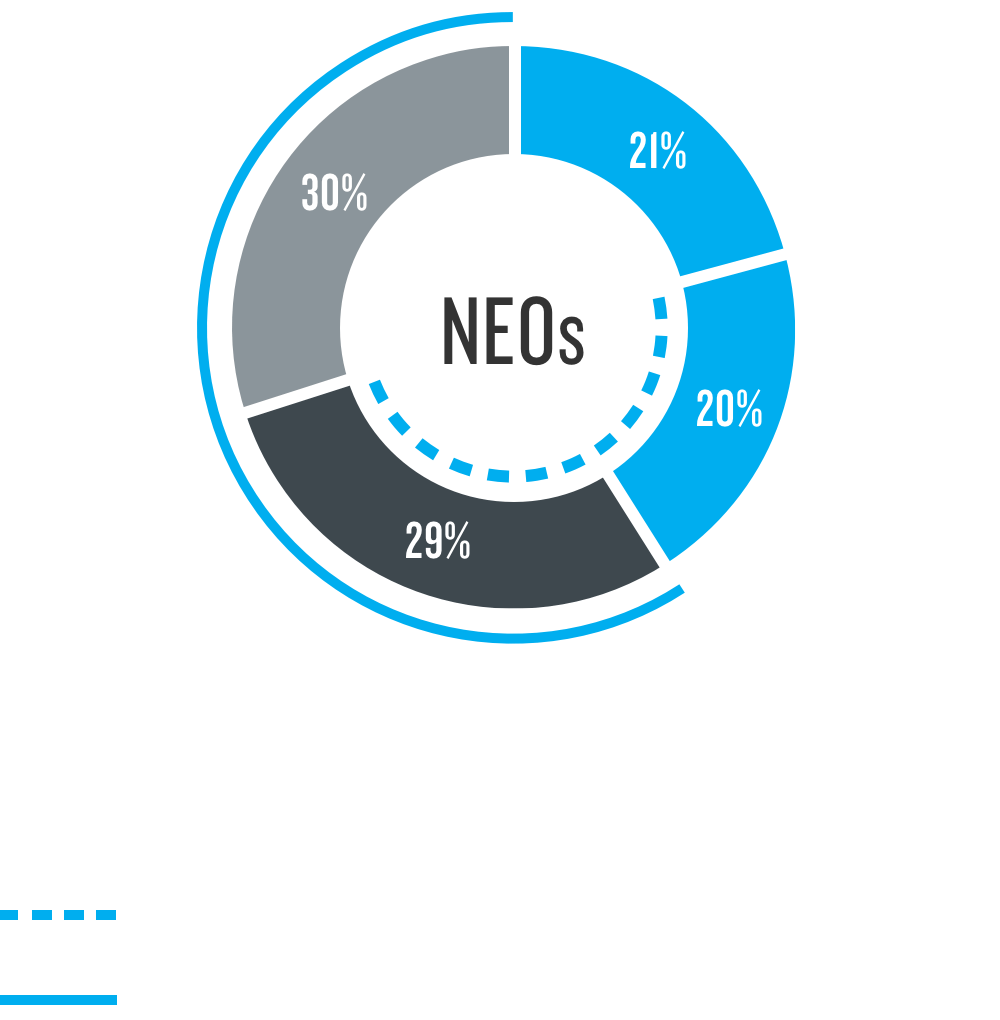

Structure 20171

incentive

(three-year performance period)

| Proportion of pay subject to specific quantitative performance criteria | 49% |

| Proportion of pay at risk | 79% |

| Proportion of pay delivered in the form of equity | 59% |

Excludes the $325,000 cash payment made to Mr. Jackson in February 2017 pursuant to the terms of his offer letter dated February 20, 2014 to compensate him for the loss of his unvested Supplemental Executive Retirement Plan (“SERP”) benefit from his previous employer (see footnote 1 to the Summary Compensation Table).

Board Highlights

Following the election and re-election of the Board nominees at our Annual Meeting, the Board will have the following characteristics:

Board Expertise and Skills

Our directors are keenly focused on building a board that supports Nielsen’s strategic goals and evolving business priorities. In that regard, in addition to the areas of experience set forth below, the qualities that are of paramount importance for our director nominees include: a proven record of success and business judgment, innovative and strategic thinking, a commitment to corporate responsibility, appreciation of multiple cultures and perspectives, and adequate time to devote to their responsibilities.

- CEO/Executive

Experience - Business and Operating

Experience - Consumer

Goods

Experience - Innovation, Technology

and Digital Experience - Global and Emerging

Markets Experience - Media Experience

- Audit and

Risk Oversight

Experience and

Financial Literacy - Research,

Analytics and

Data Science

Experience - Financial and M&A

Experience - Public Company Board

and Governance

Experience

Governance Highlights

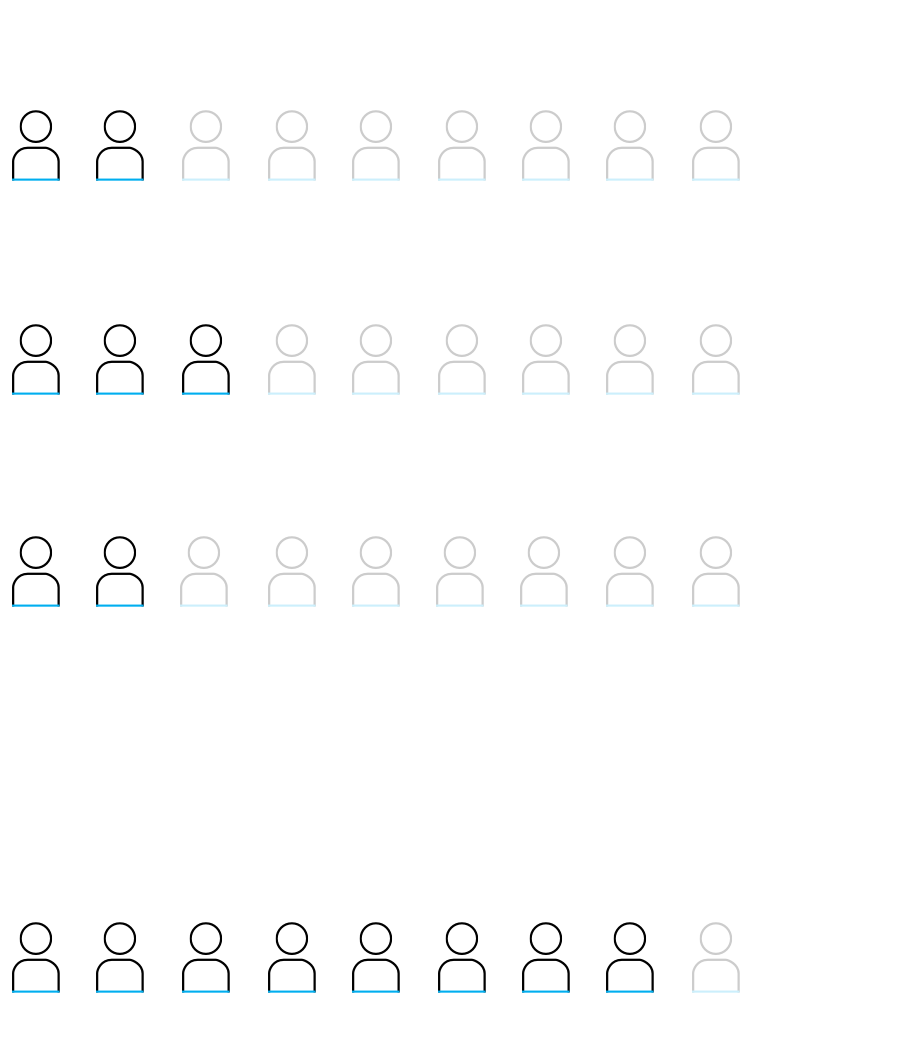

- 8 out of 9 of our director nominees are independent

- All Board committees are fully independent

- Independent Chairperson

- Ongoing focus on strategic matters, including through standalone strategy sessions

- Robust oversight of risk management

- Active engagement in talent management, leadership development and CEO succession planning

- Regular executive sessions without management present

- Five times their annual cash fees (with a transition period for new directors)

- Directors may not hedge their common stock

- No director has shares of common stock subject to a pledge

- All equity currently granted as director compensation must be held for the director’s entire tenure on the Board

- All directors are elected annually

- Shareholders have the right to call special meetings, remove and appoint directors

- Simple majority vote standard for uncontested director elections

- No supermajority vote requirements in our articles of association

- Ongoing Board succession planning

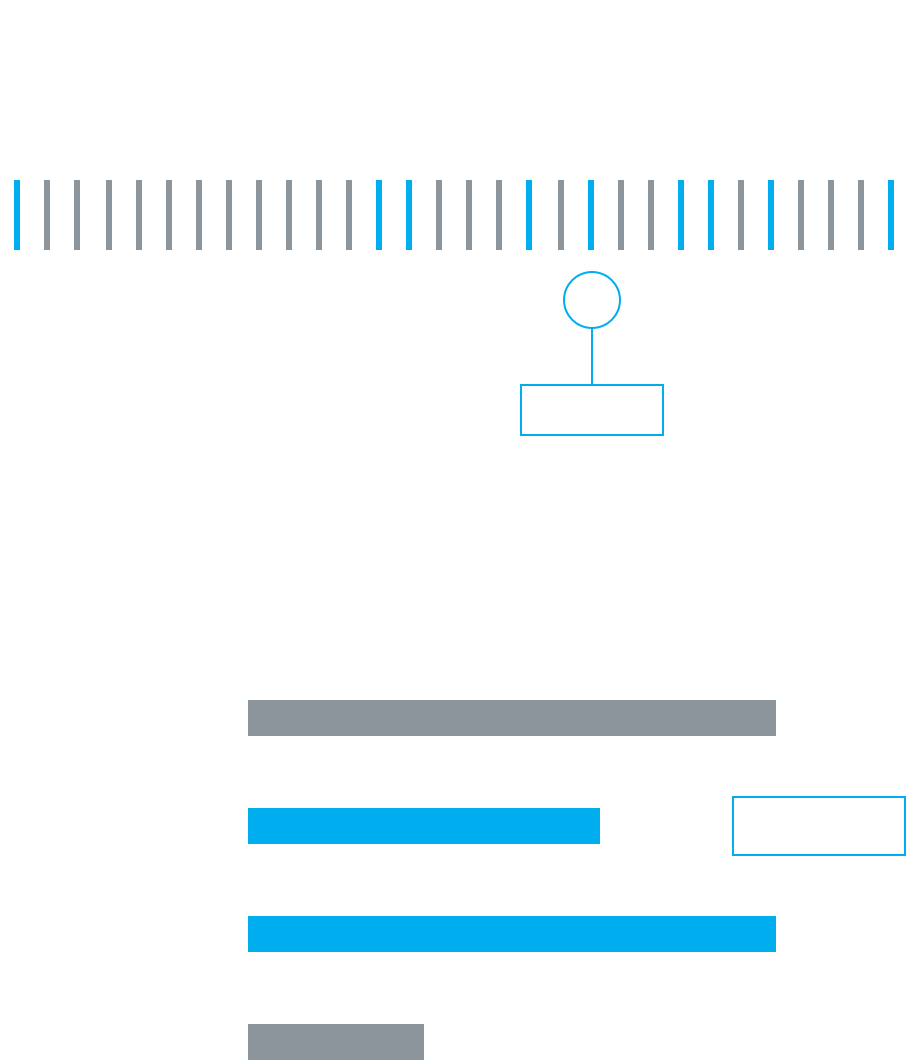

- Average tenure of director nominees is 5.1 years

- 5 new independent directors elected since 2013

- All directors attended 100% of Board meetings and at least 90% of committee meetings in 2017

- Governance guidelines restrict the number of other board memberships

- In connection with the nomination process, directors’ other responsibilities/obligations considered

- Independent Chairperson actively involved in shareholder engagement

- Directors may contact any employee directly and receive access to any aspect of the business or activities undertaken or proposed by management

- Board and its committees may engage independent advisors in their sole discretion

- Shareholders may contact any of the committee chairpersons and the independent directors as a group

Nominees for Board of Directors